- ‘Buy now, pay later’ services including Klarna, Afterpay and Affirm are paying social media influencers to promote short-term loans to Gen-Z consumers.

- These services appear as an online payment option, operating as a hybrid between credit cards and layaway.

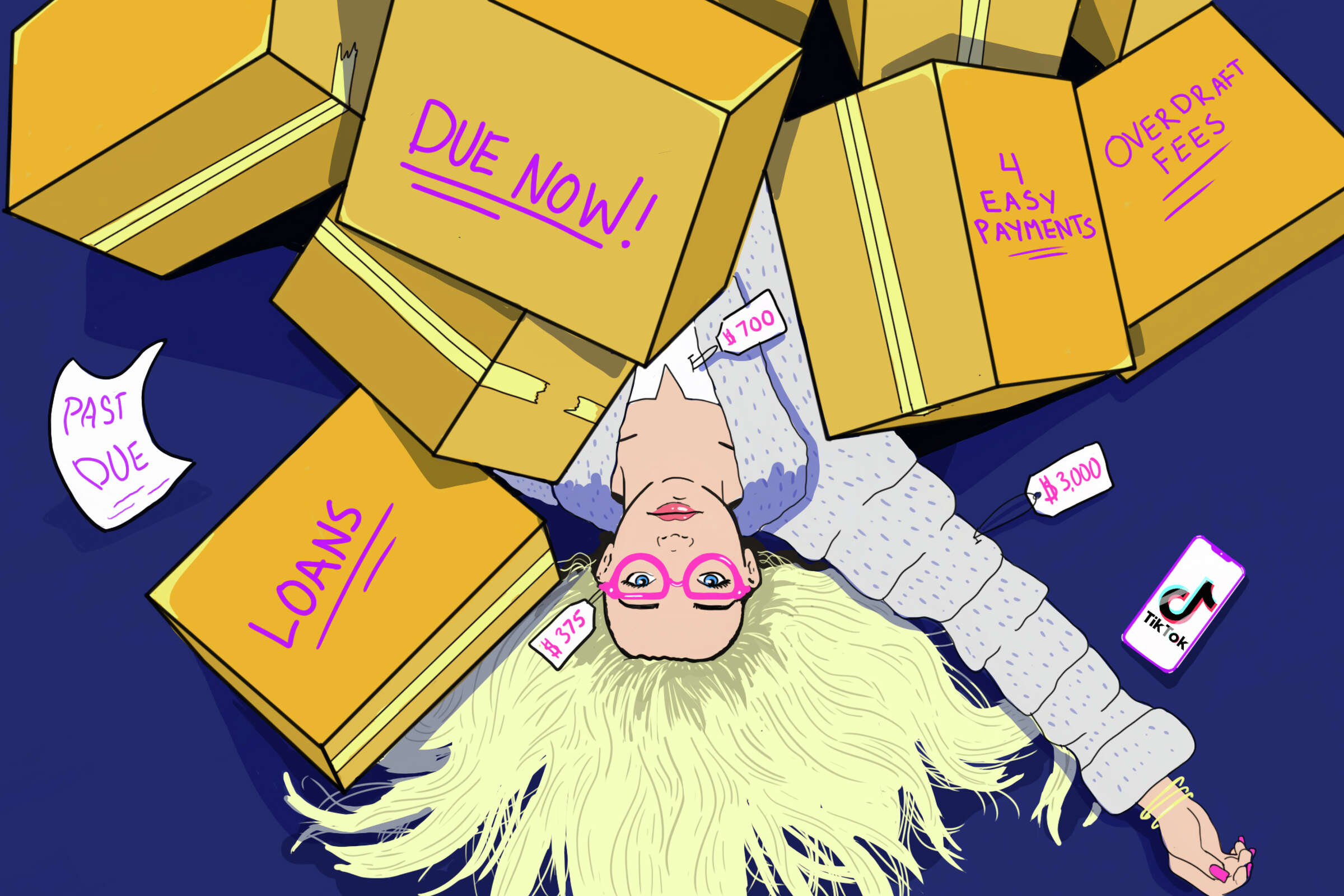

- The low monthly payments can lead to overspending; young shoppers buy now, pay later usage has increased by 925% since Jan 2020.

- While most services charge 0% interest, they charge fees on late re-payment; 43% of Gen-Z users have missed a payment.