- Rapid growth in assets under management (AUM) and business line expansion (capital markets, investment banking, etc) will make it hard for the private equity industry to replicate historical returns.

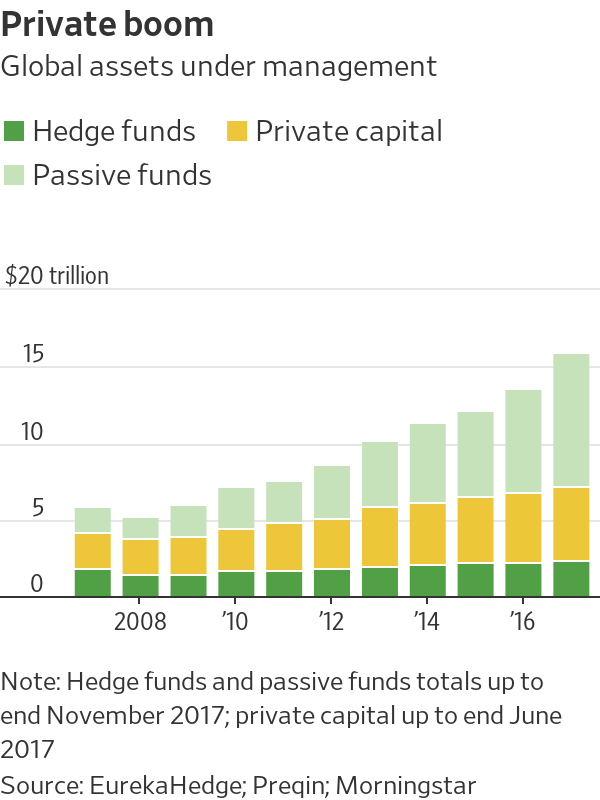

- Since 2006, industry-wide assets have tripled to $4.8 trillion with the biggest funds receiving most investor inflows (click WSJ to see chart).

- More funds with more money chasing fewer deals will reduce margins (returns).

- Many funds fear overpaying, especially before a potential downturn.

- Funds currently have $1 trillion in ‘dry powder’ buyout funds set aside.