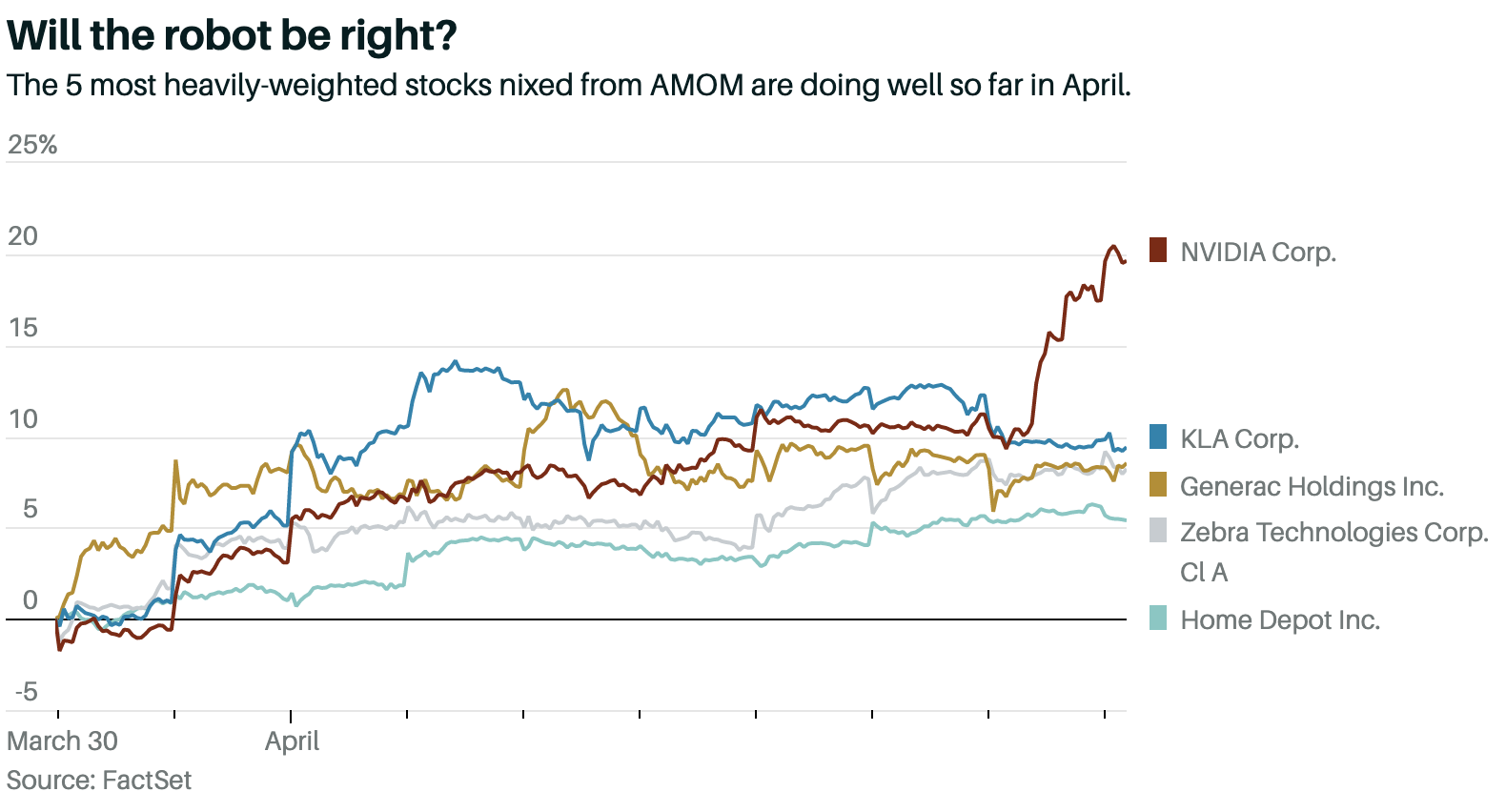

- The Qraft AI-Enhanced US Large Cap Momentum ETF (ticker AMOM) uses artificial intelligence to scan stocks within the S&P 500 for price momentum patterns, identifying stocks to buy and sell on a monthly basis.

- This South Korean AI-driven fund (launched 2019) generated returns of 79% last year vs 15.7% for the S&P 500.

- One of AMOM’s notable achievements has been consistently selling Tesla shares immediately before major corrections.

- While currently thriving, the long-term performance of relatively new AI-driven funds remains to be seen.