- Many believed that larger federal government budget deficits would lead to higher interest rates and hurt overall economic growth by ‘crowding-out’ less creditworthy borrowers.

- However, the opposite has proven true with interest rates remaining subdued despite rising US budget deficits.

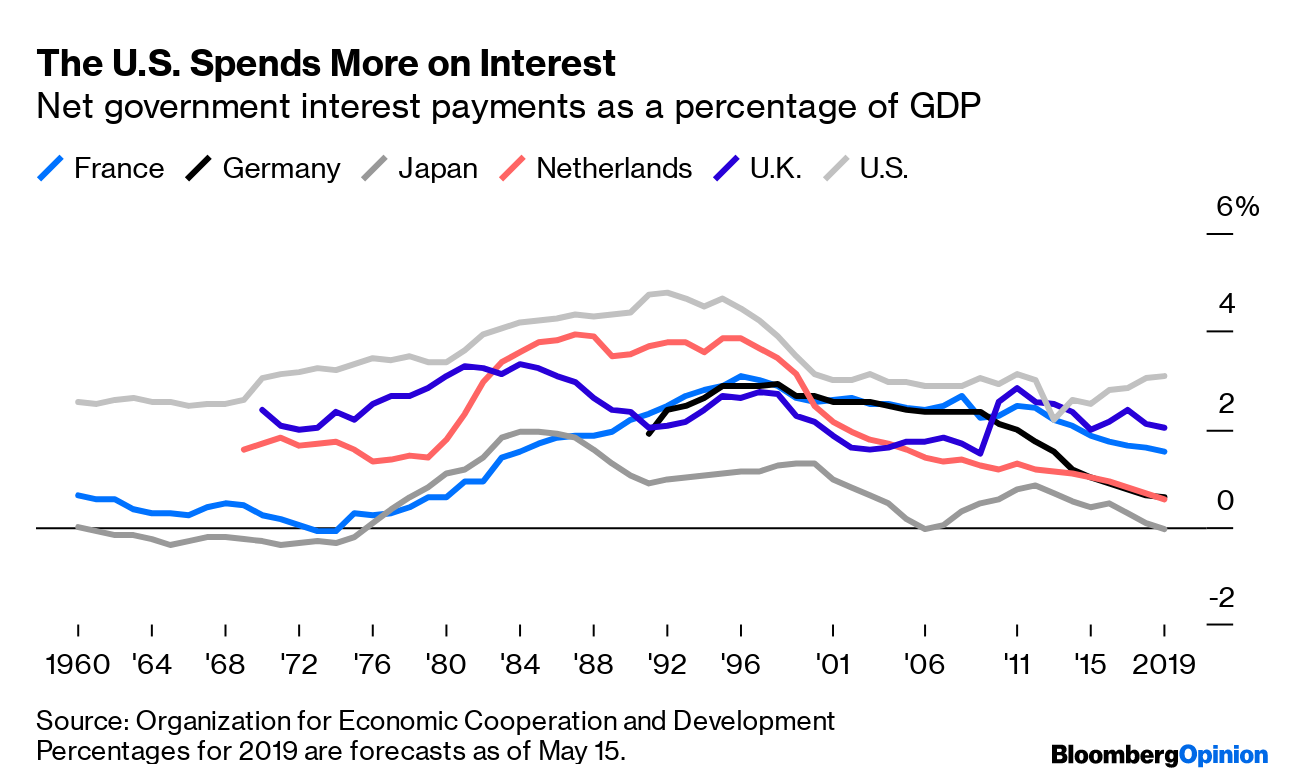

- Article explores historical net interest government debt payments, finding they spiked during wars then fell (1800s) or remained elevated (1900s).

- During the 1980s, interest rates skyrocketed and burdened governments.

- While European nations are pulling back, the US is using low rates to borrow more.