- For a decade, prominent institutions and investors have consistently voiced warnings about China’s growing reliance on debt, shadow (hidden) loans and its housing bubble.

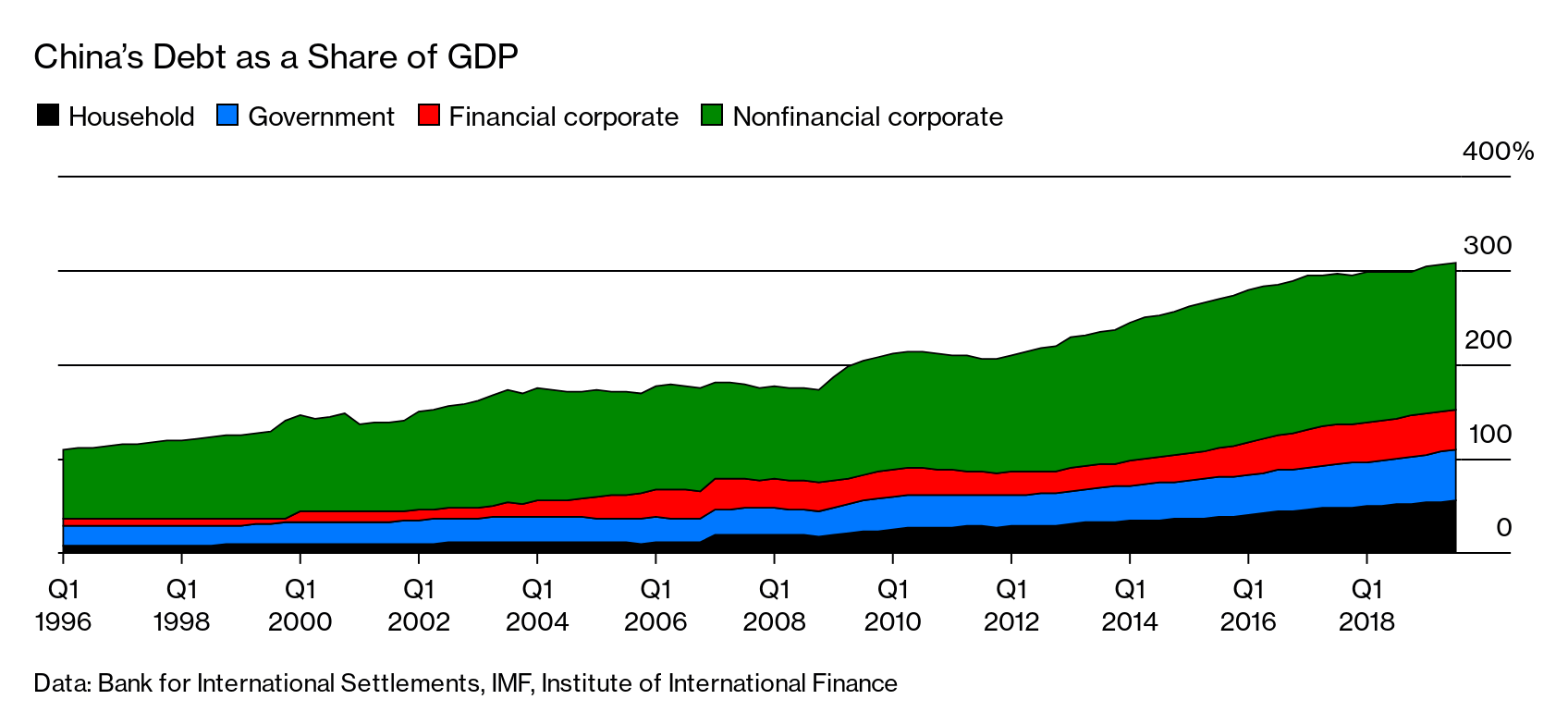

- Over this period, China’s public (government) and private debt has ballooned to over 300% of its GDP.

- However, the government has adjusted to economic threats by forcing banks to reduce bad, risky loans and raise borrowing standards.

- In many cities, borrowers must now make mortgage down payments of 70%.

- Pessimists believe the coronavirus outbreak could triple China’s outstanding bad loans.