- Trump’s 2017 tax reforms let business owners significantly reduce their taxes by shifting their wages to profits.

- Unlike publicly-traded corporations, most privately-held businesses in the US are ‘pass-through’ entities whereby profits flow directly to the owners.

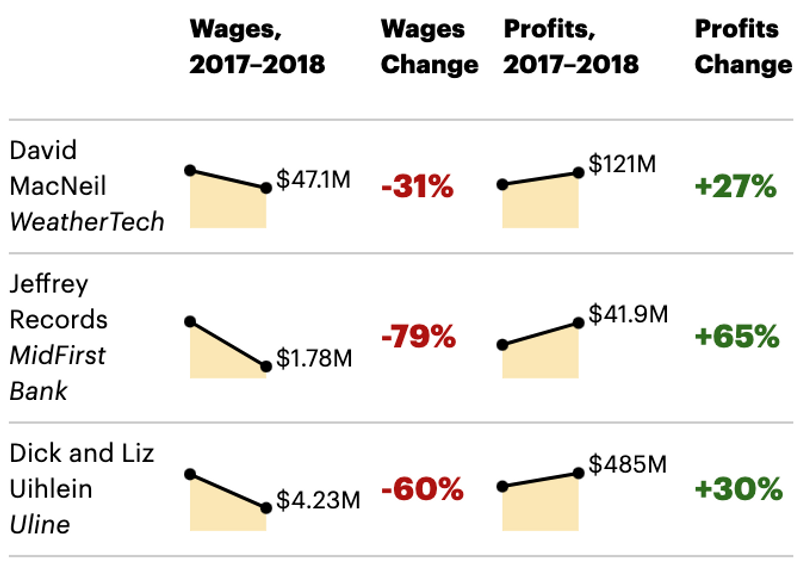

- Trump’s tax reforms encouraged pass-through business owners who are also employed by their companies to classify their wages as profits by lowering the top tax rate on profits to 29.6% (vs 40.8% top rate on wages).

- Article explores how executives and politicians have capitalized on this loophole.