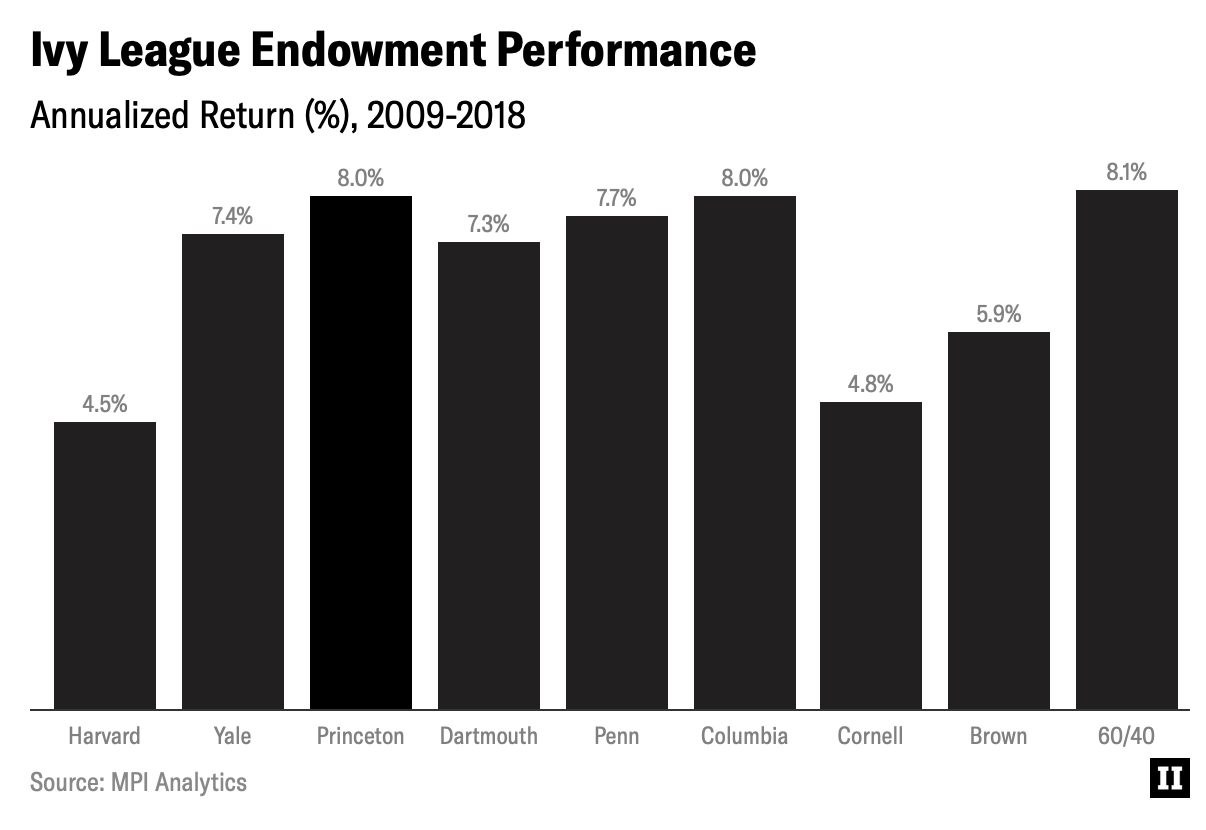

- Over the last 10 years, Ivy League endowment funds (Harvard, Yale, etc.) have lagged the average passive portfolio of 60%/40% US stocks/bonds.

- Ivy endowments have returned 4.5-8% per year vs 60/40 average performance of 8.1%.

- Since the early 2000s, endowments have tried replicating the Yale Model of investing heavily in riskier, alternative assets (private equity, venture capital, hedge funds).

- Yale outperformed by implementing this approach in the 1980s; as more have copied, it’s become less profitable.