- After the financial crisis (2010-11), private equity firms started investing more ($3 billion) into auto finance companies that offer high interest rate loans (11%+) to borrowers with poor (subprime) credit.

- Subprime auto loans have increased by 72% since 2011.

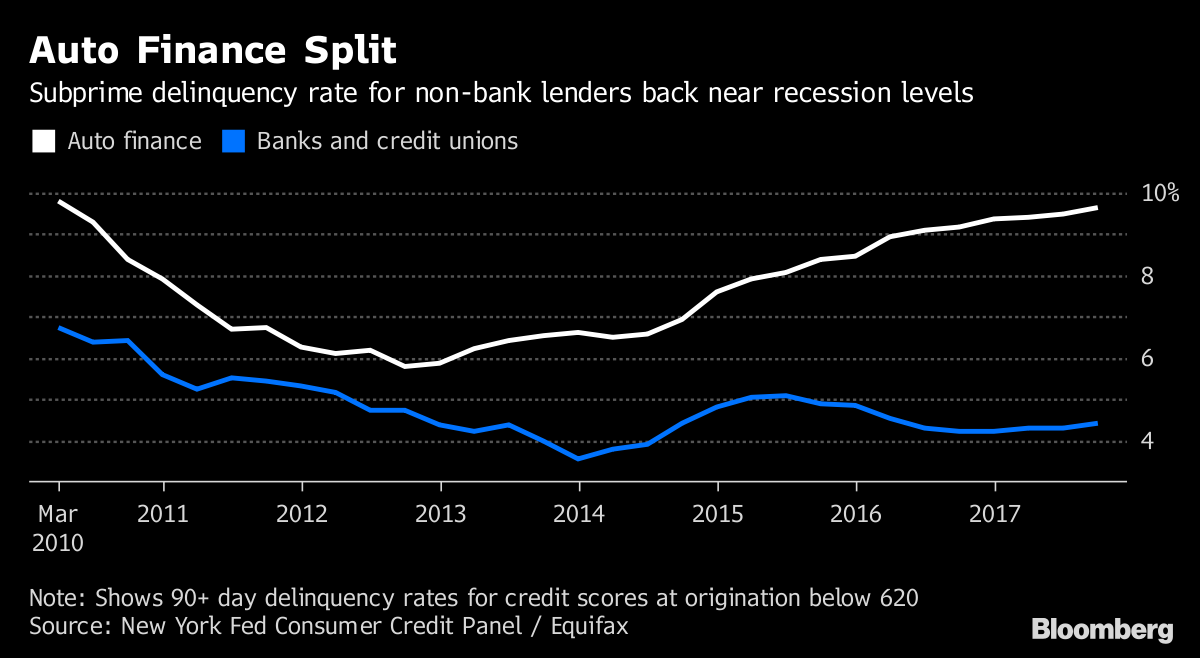

- However, lenders seeking greater profits lowered their standards to the point where losses currently exceed profits.

- Regulators are investigating predatory auto lending.

- Mounting losses have sapped interest in auto lender IPOs, a common exit for firms to cash out of investments.